The situation in the real estate market for residential property was exceptional in 2022 due to the sharpest rise in interest rates in 30 years. Nevertheless, it was robust overall, with prices rising again, although the price momentum slowed down compared to the previous year. The number of property sales also declined. Here, the location played a central role in determining the price, as an analysis of the effective sales prices of the past year showed. A distance of only 35 kilometres, as the crow flies, was enough to be able to buy six single-family houses for the same price as one. Overall, an average increase of 5.7 per cent was observed for condominiums, while the increase for single-family houses was still 4 per cent.

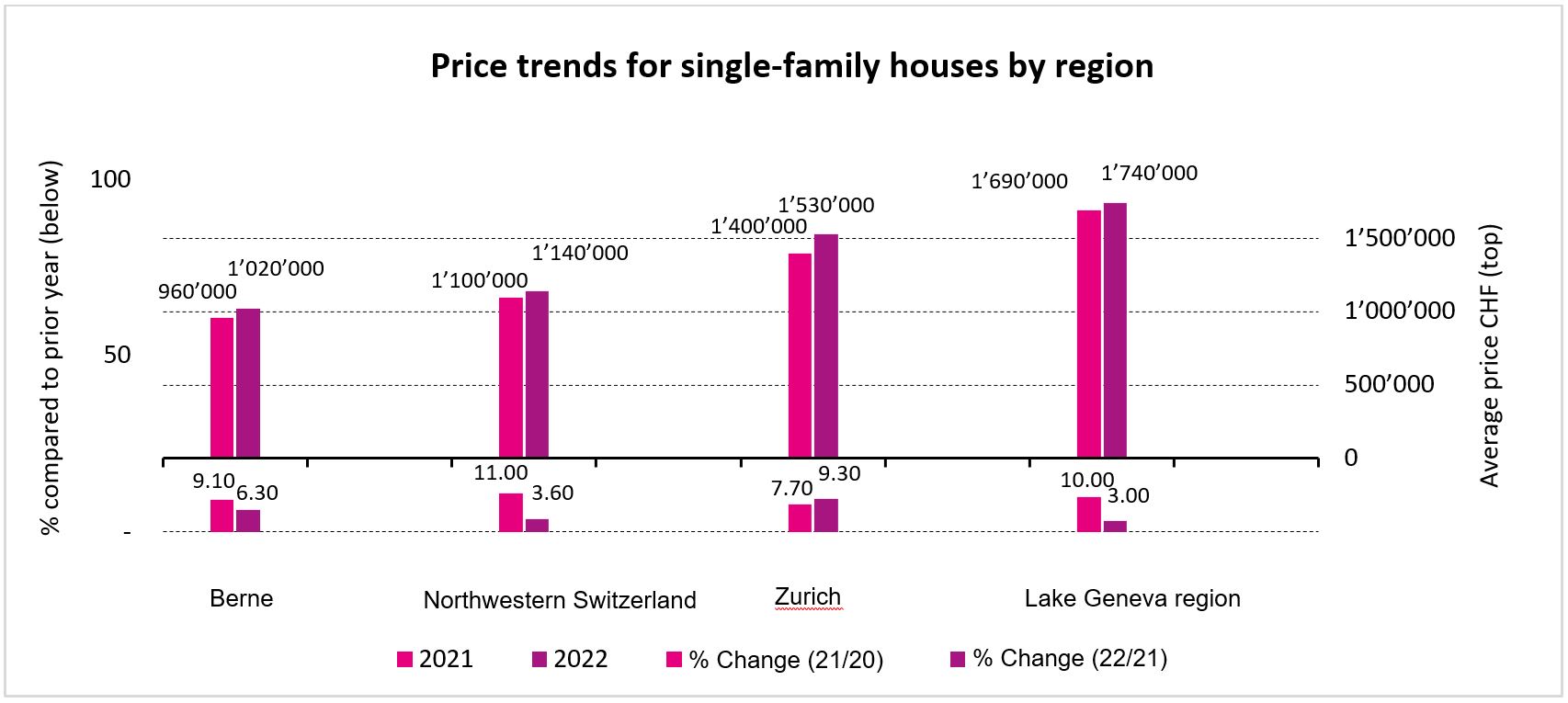

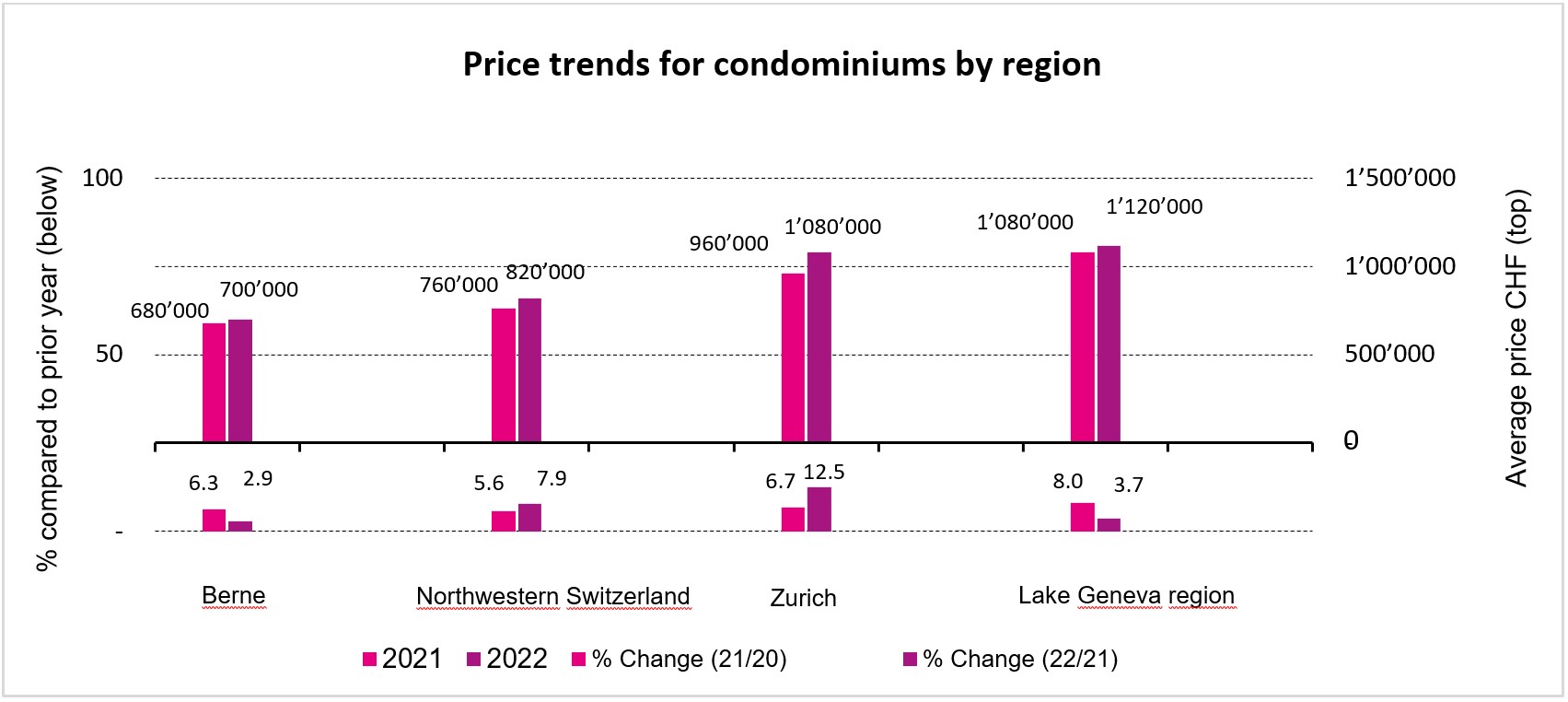

Zurich, 1 March 2023 – Despite the sharpest rise in interest rates in 30 years, prices for residential real estate rose again in nominal terms in 2022, although much less strongly than in the previous year. In the case of single-family houses, prices increased by an average of 4 per cent last year, which was significantly below the previous year’s value of 9 per cent. In the same period, prices of condominiums increased slightly by 5.7 per cent – again less markedly than in 2021, which equalled an increase of 8.3 per cent. However, a closer look at the four regions of Switzerland with the most transactions (purchases and sales of single-family houses and condominiums) – Zurich, Northwestern Switzerland, Bern, and Lake Geneva – reveals a differentiated picture. Adjusted for inflation, only half of the regions still show a price increase for either single-family houses or condominiums.

The analysis by Homegate and ImmoScout24, together with the Swiss Real Estate Institute, is based on the effective sales prices of the Swiss Real Estate Data Pool. This includes the owner-occupied properties financed by Credit Suisse, UBS and Zürcher Kantonalbank and covers around 40 per cent of all transactions in Switzerland. In 2022, about 7,200 sales of owner-occupied homes were registered in the regions surveyed. As in the previous year, this represents a decline of around 10 per cent compared to 2021, which, however, unlike in the previous year, was largely reflected in the number of condominiums sold.

Martin Waeber, Managing Director Real Estate, SMG Swiss Marketplace Group, sees the reasons for the slowdown in price increases primarily in the sharp increases in key interest rates and the resulting rise in mortgage rates, as well as a declining effect of working from home compared to 2021: “The dampening effect of rising interest rates on the development of home prices predicted at the beginning of 2022 has been confirmed, albeit to a lesser extent than one might have assumed. However, home prices seem to have slowly reached their zenith. Apart from the fact that many people simply can no longer afford to buy their own home at current prices, the decreasing use of home office has also had an impact. Both factors dampened the price increase in the course of the past year.” However, in view of the scarcity of land and the continuing influx of people into Switzerland, a real estate bubble is not to be expected in this country, Waeber continued. This is especially true since properties for sale are still very popular, especially in places like Geneva and Zurich.

Single-family houses in the Lake Geneva region over 70 per cent more expensive than in the Bern region

With strong price growth of 9.3 per cent, prices for single-family houses in the Zurich region rose the most in 2022 – and was even the only region with a higher price increase than in 2021 with an increase of 7.7 per cent. The average single-family house cost CHF 1.53 million. As a result, the Zurich region increasingly caught up with the Lake Geneva region, which remained the most expensive; the gap between the average single-family house price in the Lake Geneva region narrowed by CHF 80,000, or 28 per cent, compared to the previous year. In the Lake Geneva region, an average property cost CHF 1.74 million in 2022, 3 per cent more than in 2021. In the Bern and Northwestern Switzerland regions, average property prices for single-family houses also converged somewhat, with prices in the Bern region recording an increase almost twice as high (6.3 per cent to CHF 1.02 million) as in the Northwestern Switzerland region (3.6 per cent to CHF 1.14 million). Taking into account last year’s inflation, this resulted in only a minimal price increase of 0.8 per cent for Northwestern Switzerland. Nevertheless, Bern remains the cheapest region to buy a single-family house.

Condominiums in the Lake Geneva region are now almost as expensive as in the Zurich region

For condominiums, the growth in the Zurich region for 2022 was restrained at 3.7 per cent, especially compared to that of single-family houses. Nevertheless, properties in this region remain the most expensive of all four regions surveyed, averaging CHF 1.12 million. Due to a considerable price increase in the Lake Geneva region of 12 per cent compared to 2021, the difference to the front-runner narrowed significantly (from CHF 120,000 to CHF 40,000). The Bern region continues to be by far the cheapest for potential buyers of condominiums. Average prices here rose by only 2.9 per cent to CHF 0.7 million last year. Taking inflation into account, this region can even be said to have stagnated. In addition to the Lake Geneva region, the second cheapest region – Northwestern Switzerland – was also unimpressed by rising interest rates and the declining trend towards working from home: in 2022, prices rose by 7.9 per cent, which is even significantly higher than in the previous year (5.6 per cent). At CHF 820,000, an average condominium now costs CHF 60,000 more than it did in 2021.

Looking at property prices per square metre of net living space, there is an additional effect, particularly in the Lake Geneva and Zurich regions. In the Zurich region, prices per square metre rose significantly faster than property prices in the same period. This indicates falling residential areas of the traded properties. In the Lake Geneva region, on the other hand, the opposite was true, i.e. property prices rose five percentage points more than prices per square metre. As a result, larger properties tended to be sold on the market in the Lake Geneva region for 2022 than in 2021.

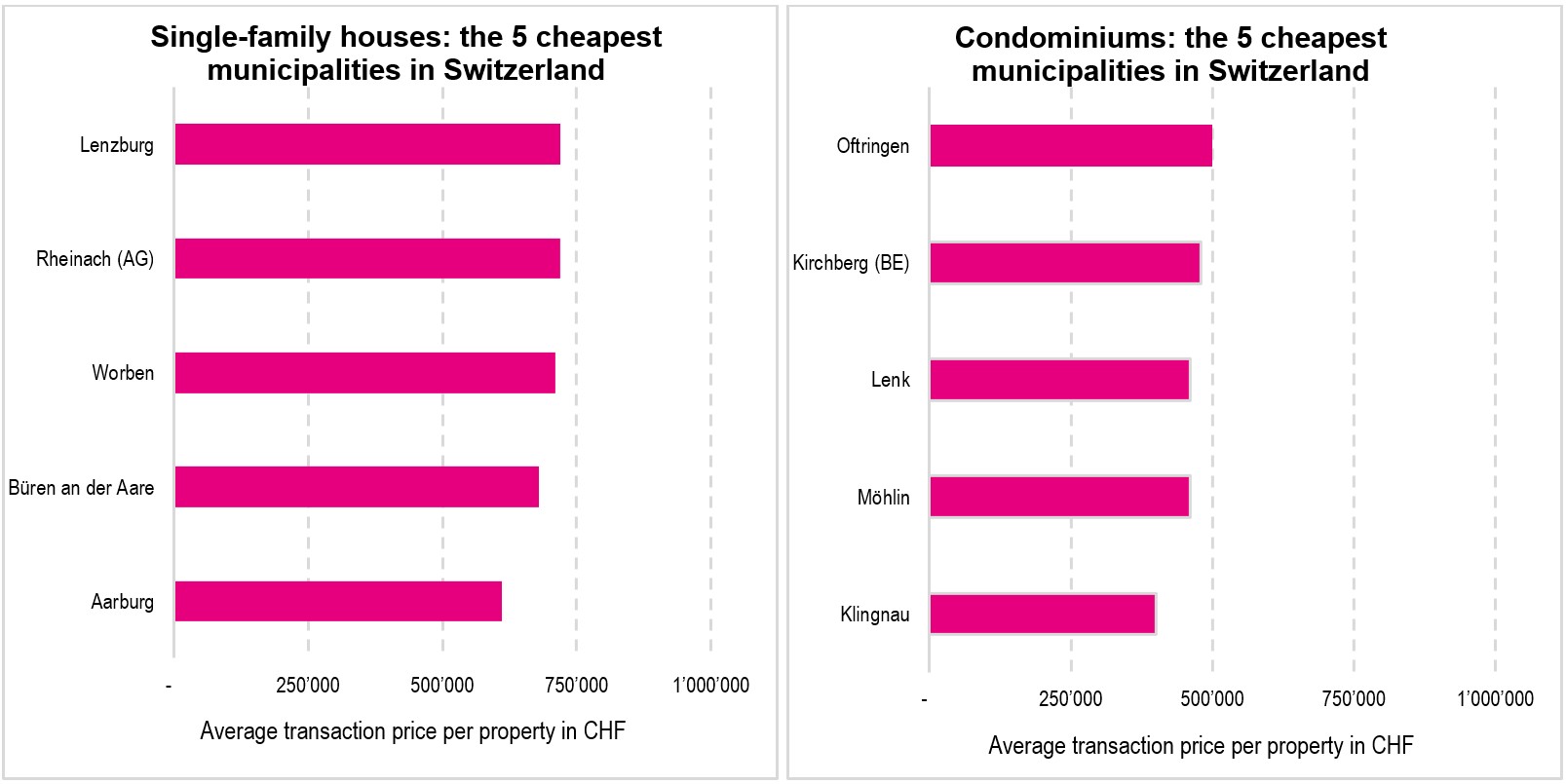

The cheapest houses are in Aarburg, the most expensive in Uetikon am See

Not surprisingly, of the five municipalities with the highest median prices for single-family houses, three came from the Zurich region. The most expensive are in Uetikon am See (CHF 4.0 million), followed by Kilchberg (CHF 3.68 million) and Meilen (CHF 3.41 million). These are followed by two municipalities in the Lake Geneva region, Vésenaz (CHF 3.06 million) and Nyon (CHF2.98million).

Two findings are worth noting: firstly, all five of the most expensive municipalities for single-family houses were not listed last year; secondly, prices in this highest segment have risen significantly once again. When it came to the highest median prices for condominiums, all five municipalities came from the Zurich region: led by Küsnacht (CHF 2.52 million), Zumikon, Herrliberg and Meilen (CHF 2.3 million each) and Erlenbach (CHF 2.16 million).

On the other side of the scale, the cheapest residential properties in the four regions studied – for both single-family houses and condominiums – all come from the canton of Aargau. Depending on the municipality, condominiums are priced from CHF 400,000 (Klingnau), while single-family homes could be purchased last year from CHF 610,000 (Aarburg). This shows impressively: for the price of a condominium in Küsnacht in Zurich, there are six to buy in Klingnau, less than 35 kilometres away. And almost seven single-family houses – or a complete apartment building – can be bought in Aarburg for the price of one in Uetikon am See. These two towns are also just 60 kilometres apart as the crow flies.

Note on the evaluation at municipality level: only those municipalities were included where at least five owner-occupied home transactions were recorded in the Swiss Real Estate Data Pool for 2022. The prices are based on average values and are not quality-adjusted. This means that in individual sub-segments, the sale of luxury homes, in particular, could have an influence on the comparison with the same period of the previous year.

Peter Ilg, Head of the Swiss Real Estate Institute, summing up the results of the latest Home Market Price Analysis, is amazed at how robust price growth is in the owner-occupied housing market: “After nine years of negative interest rates, the turnaround in interest rates came abruptly last year with several key interest rate increases totalling 1.75 percentage points. This is the first time in over 30 years that the Swiss National Bank has raised the key interest rate so significantly within one year.” Falling home prices in Switzerland at this turning point – combined with a trend towards a decline in the use of home office – would therefore not have surprised Ilg. “Nevertheless, I am amazed at how robust the price growth in the owner-occupied home market is. In three of the eight segments examined, price growth was even significantly higher than the previous year despite this headwind,” Ilg said, summarising the findings of the Home Market Price Analysis for 2022.

Fabian Korn

Communications Manager